The UK government has announced changes to the taxation on energy storage batteries – a move that was an important step for energy efficiency.

The plans that have been unveiled have granted relief that extends far further than the previous VAT relief policy.

The original policy was limited to batteries installed at the same time as solar panels, but from the 1st February 2024 it will no longer be limited to that.

Upon implementation, standalone batteries and retrofitted batteries will not be subject to a VAT payment, marking a huge moment in the UK’s transition to green energy.

The history of the VAT relief

Since the Spring Statement of 2022, certain energy-saving domestic equipment, like heat pumps and roof-mounted solar, has enjoyed VAT exemption.

Battery Energy Storage Systems (BESS) were also exempt but with the condition that they must be installed alongside other energy-saving materials, such as solar.

However, in a statement released on 11th December, the UK government made a noteworthy announcement—retrofitted BESS will now also be exempt from VAT.

This development follows advocacy efforts by key players in the energy industry, including from us at Infinity Innovations.

What battery systems fall under the new relief?

- Battery storage and solar installation

Originally announced as part of the Spring Statement of 2022, all dual installations of solar panels and energy storage batteries.

They will continue to be included under the new plans.

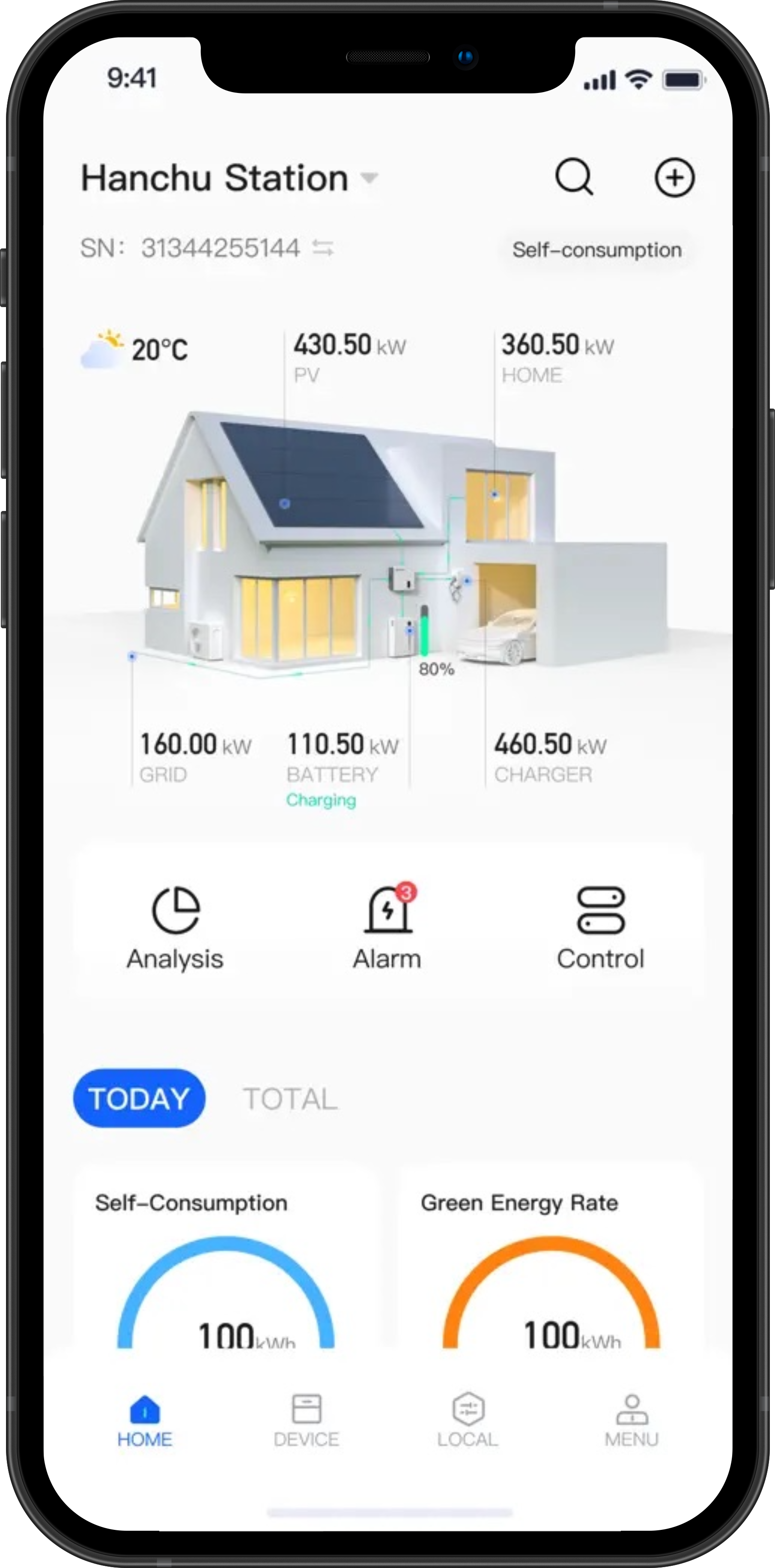

- Standalone battery storage

This now includes batteries that are installed without solar panels as part of their project. These systems will allow consumers to make use of smart tariffs by charging them cheaply overnight. They can then discharge the stored energy in their battery during peak hours, easing pressure from the national grid, reduce the burning of fossil fuels and save money.

- Retrofit batteries

Installations where a battery is added to an already existing solar array represent a significant advancement.

With the integration of a storage battery, individuals can harness and preserve the sun’s energy to power their homes from sunrise to sunset.

This not only amplifies energy bill savings but also leads to more substantial home carbon reductions and enhanced control over energy consumption.

Infinity Innovation’s view

We have welcomed the news of the tax relief at Infinity Innovations, and it is an action that was long overdue.

This will make a huge difference in the cost of an already smart investment, and it gives us faith in the seriousness that the UK is taking in becoming a world leader in green energy.

After this announcement, we expect there to be more demand and interest in the products that we supply, thus creating a wider network of people using sustainable energy. We also anticipate increased demand for fantastic products, which will help drive further technological developments in the fight against climate change.

Are you interested in taking advantage of the tax relief on energy storage batteries? Get in touch with one of our trained and experienced installers today who can talk you through the process of getting a battery installed.

Inverters

Inverters

Batteries

Batteries

EV Chargers

EV Chargers

Heat Pumps

Heat Pumps

Radiators

Radiators

Greenlinx

Greenlinx